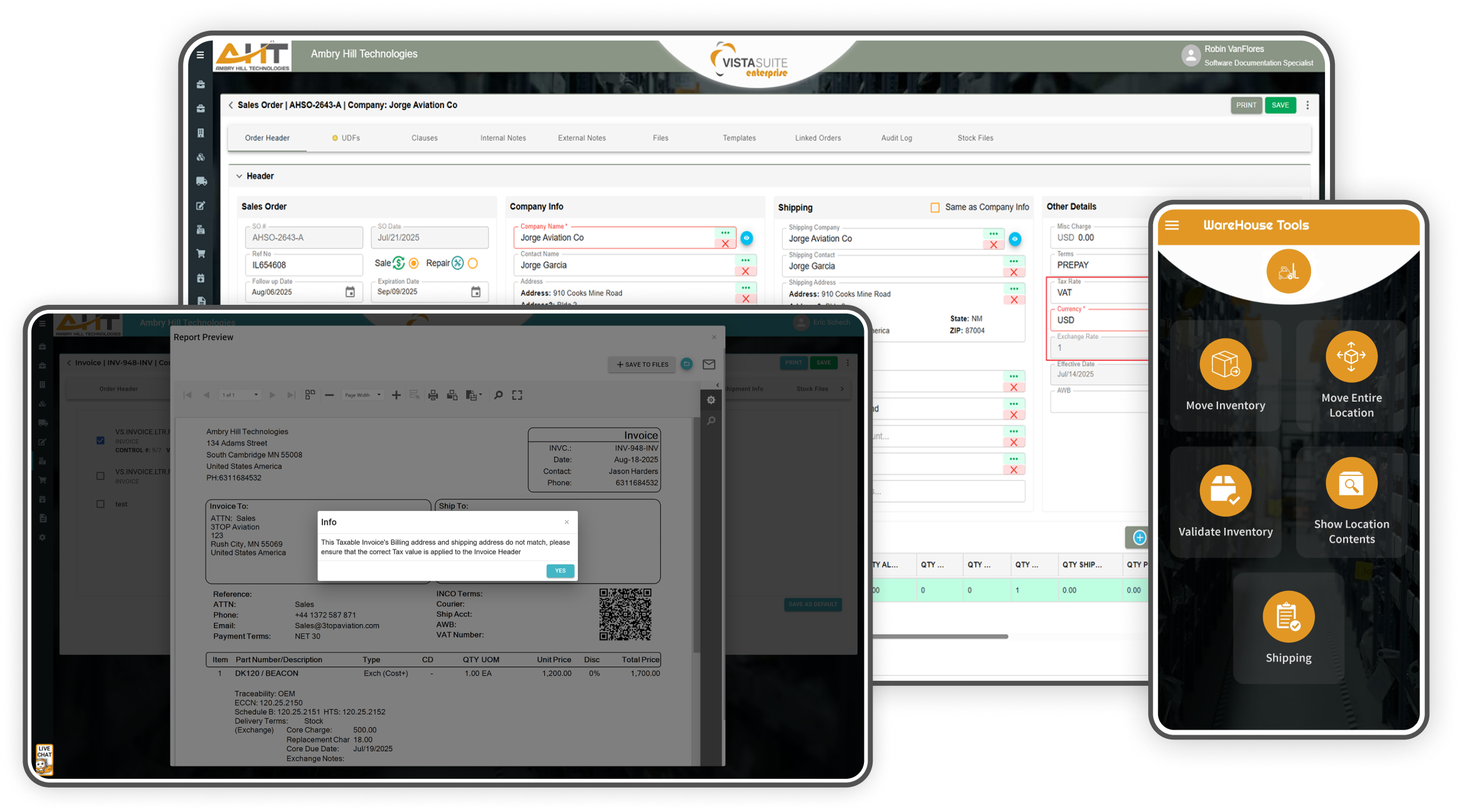

Transaction-Level Currency Conversions and Company-Specific Tax Rate Management

Whether billing foreign customers for component repairs or managing purchase orders with international suppliers, Vista-Suite Enterprise gives you direct control over currencies and tax settings within the transactions you create every day. With built-in Multi-Currency and Tax Management capabilities, users can apply the correct financial settings at the point of entry, eliminating the need for spreadsheets, finance team handoffs, or guesswork. Unlike other ERP systems that silo these functions in the back office or limit configurability, Vista-Suite Enterprise makes it easy to reflect accurate financials across all locations and for all transaction types from the very beginning.

Expand Each Topic for Details:

Support your international customers with multi-currency capacities. Home and Foreign currency fields are displayed throughout the system, and the printed business forms display the foreign currencies as well.

Automatically update your exchange rates from the Open Exchange Rates platform, a trusted global provider of currency exchange rate data for 100,000 businesses.

Stores exchange rate and exchange rate effective date for each transaction.

Set a base currency for company-wide accounting and reporting consistency.

Choose alternate currencies on a per-transaction basis (quotes, purchase orders, invoices, etc.) based on customer or vendor requirements.

Easily view a transaction’s home and foreign values with the proprietary currency toggle. No more cluttered screens with "home" and "for" currency values.

The system supports multiple decimal places for all price, cost, and quantity fields for more granular management of fractional amounts typically caused when currency conversion occurs.

Assign individual tax codes to customers or vendors so the right tax logic is applied automatically.

Define a tax rate percentage to each part or charge transaction type , such as one rate for outright sales and another rate for exchanges.

Orders offer a "cost pass-through" option for freight and misc. costs which will bypass the tax calculations and is conveniently separated from line items in the transaction headers.

Track the Tax Payer ID number and the Economic Operators Registration & Identification (EORI) number against customer and vendor records for reporting.

Optional Invoice setting that alerts you if an invoice is taxed and the shipping destination does not match the billing information.

Eliminate the need for external spreadsheets or follow-up tax adjustments common in other systems.

Why It Matters

Accurate currency and tax handling at the transaction level reduces downstream issues like incorrect billing, payment delays, or mismatched financial reports. When these details are handled up front by the users entering quotes, orders, and invoices, it saves time across departments and prevents frustrating rework. Vista-Suite Enterprise includes these critical settings as part of the normal workflow, not an afterthought.

See a demo by contacting sales@ambryhill.com

Tax Rates and Multi-Currency Conversion

Tax Rates and Multi-Currency Conversion